Transaction

This documentation is incomplete.

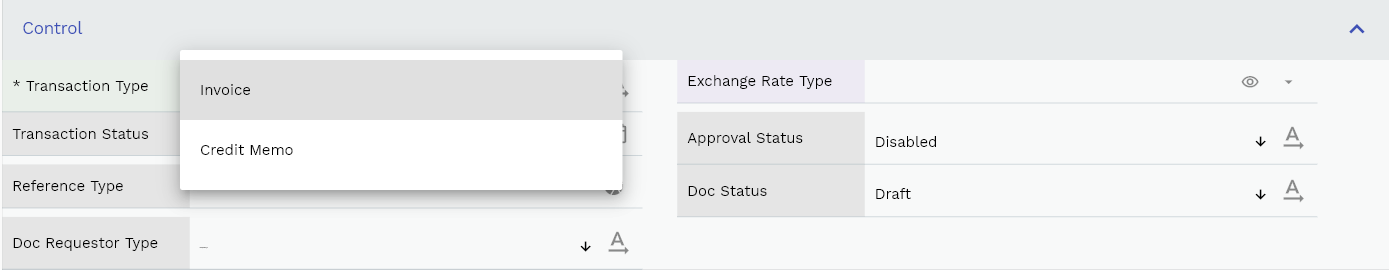

An AP invoice is a document received by a business from a supplier specifying the goods and services purchased from the supplier. In inoERP, you can create an invoice using the transaction screen. You can also use the transaction screen to create Credit Memos. The application also allows you to create Invoices from a purchase order.

You can create a transaction from a purchase order/PO receipt. You can also create a transaction by manually entering all the required information such as supplier, items/product description, quantities, date, etc.

If the purchase order detail has Two Way match, the system allows you to create invoices without a receipt. However, if the match option is three ways, you need to receive the purchase order to create the invoice.

A transaction consists of

- Header

- Line

- Detail

Header

A transaction header contains the supplier, business unit, currency-related information. When converting a transaction to an Invoice, the system copies all the header level information to the destination document.

To view/create/update a transaction, navigate to the "transaction" search screen from your dashboard/favorite.

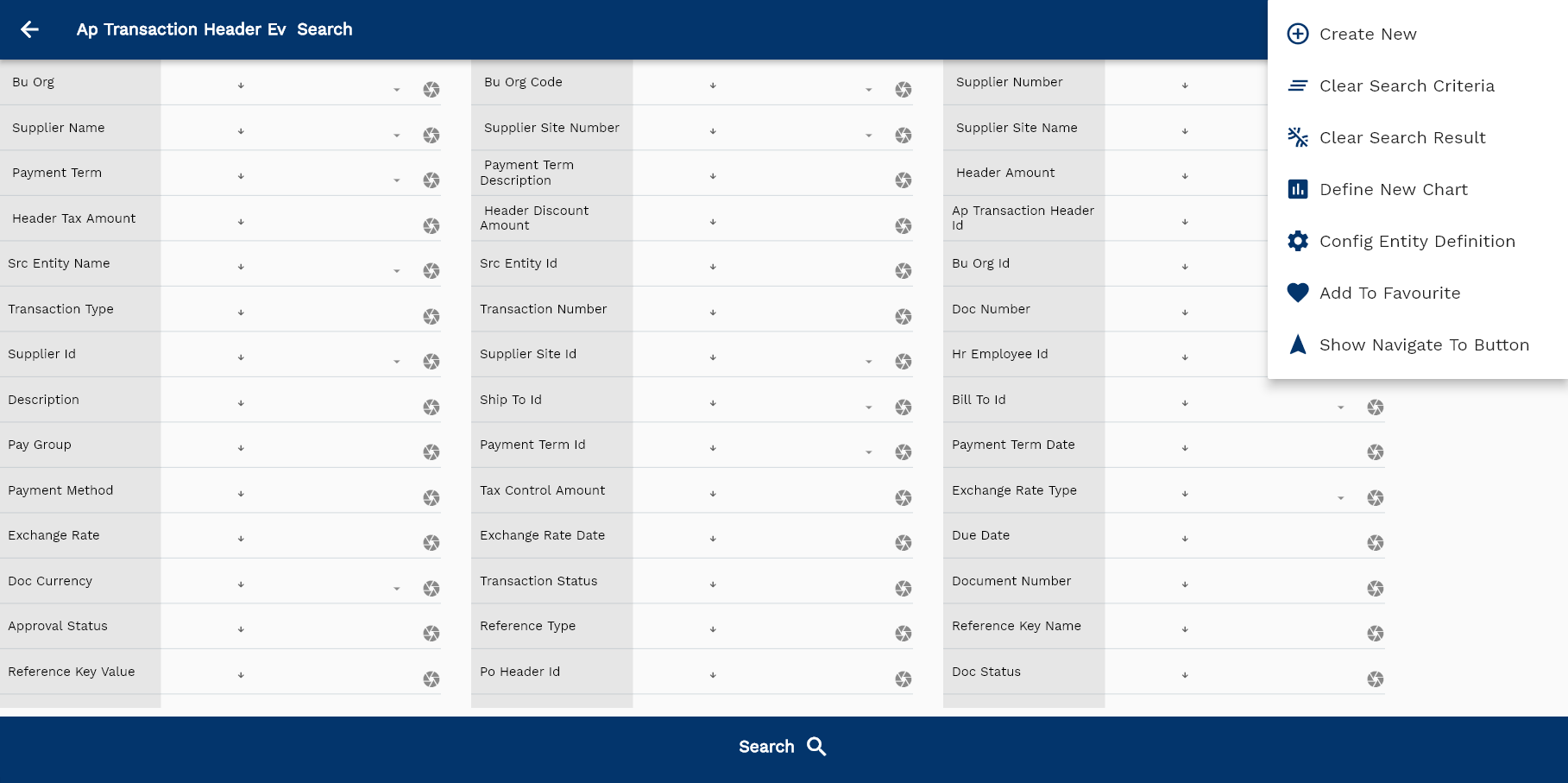

Enter the organization/transaction details or any other criteria in the search form and click on the search button to view an existing transaction.

Click on create a new button to create a new transaction; by manually entering all the information,

Copy an existing transaction to a new transaction is always better than manually entering all the data to create a new transaction.

The application lets you update all the details before confirmation; you can configure which fields are view-only after the confirmation.

If you don't enter organization/supplier details, the system will show you all the transactions. If your organization has configured to make any field mandatory for search, then you have to enter those fields to search transactions.

The application will fetch all the server data and take you to the search result screen. The search result screen looks a bit different on desktop and mobile devices.

To view the search result in a table format, click on the table icon available on the bottom left corner.

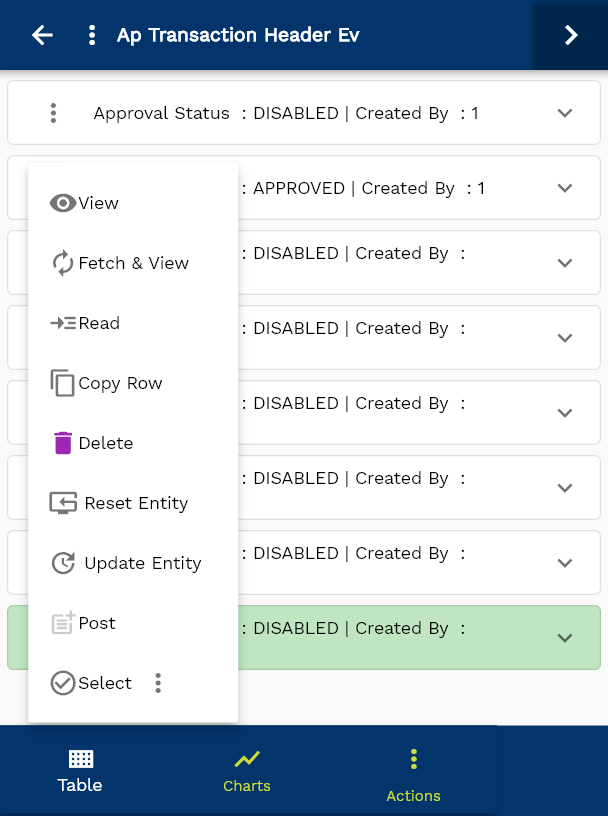

To open a specific transaction, click on the menu of that record, and click on view/fetch & view.

You can also click on the expand icon against any item on the search result screen to view the transaction header details such as transaction number, quantities, start date, status, etc.

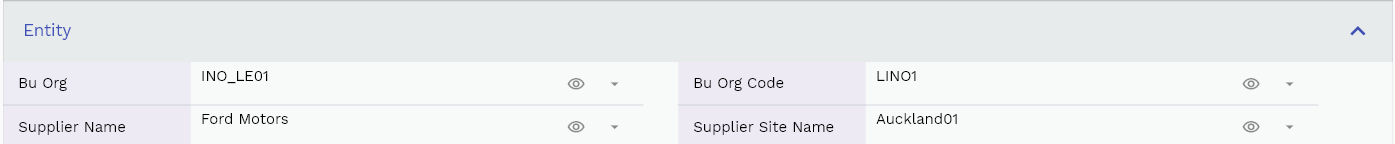

Business Org: Select a business organization from the list. The system shows only that business org to which you have access. You can either select the business org from the list or enter the business org code. The system will default all the other fields based on the chosen business org. The business org is a mandatory field and can't be changed after the document is saved. If you change the business org, the system will remove the values from all the other fields.

Supplier Name: Supplier name is a mandatory field in the header. Select a Supplier name from the drop-down list. The system defaults Supplier number, Supplier id, etc., from the Supplier name. You can also enter the Supplier number, Supplier id, etc., and the system will default the Supplier name.

Supplier Site Name: Supplier site name is also a mandatory field in the header. Select a Supplier site name from the drop-down list. The system defaults the Supplier site number, Supplier site id, etc., from the Supplier site name. You can also enter the Supplier site number, Supplier site id, etc., and the system will default the Supplier site name. If you select a Supplier site name before entering a Supplier name in the header, the system will default the Supplier name from the selected site name. The system also defaults other information (such as payment terms, document currency, etc.) from the Supplier site.

The system will fetch all the data related to the selected sales order. The sales order details are shown either right to the search result screen or in a separate screen, depending on the device size.

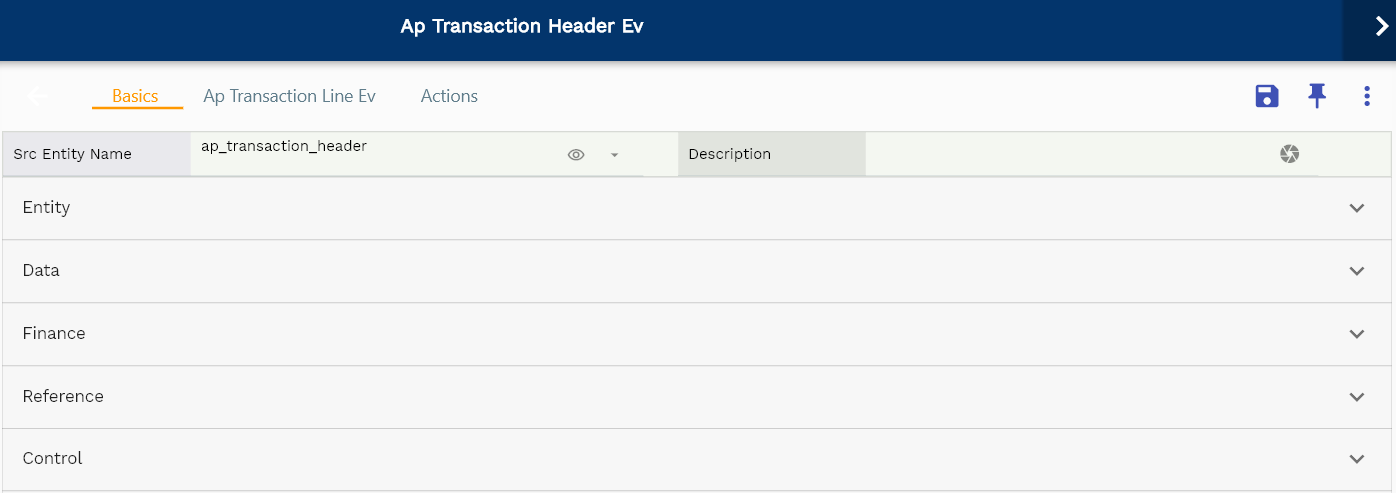

The system will fetch all the data related to the selected transaction. The transaction details are shown either right to the search result screen or on a separate screen, depending on the device size.

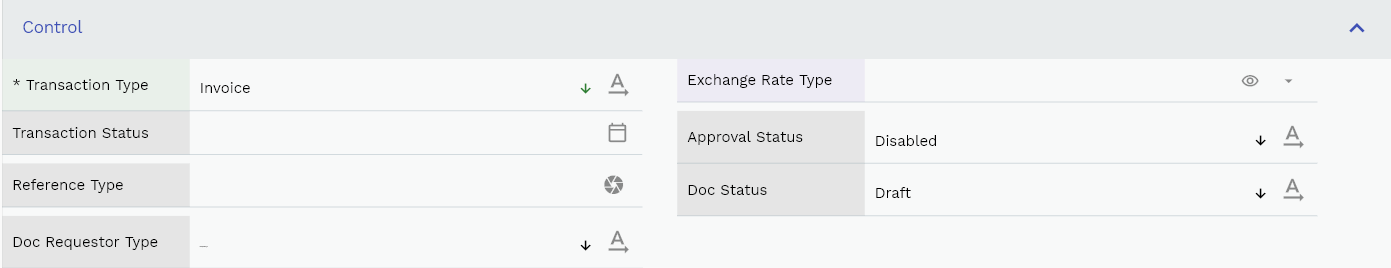

Doc Status: A read-only field showing the document's current status. The value is maintained by the system and changed depending on actions and transactions on the record. The system will default the document status to "Draft" for a new document.

Accounting Status: A read-only field showing the current accounting status of the document. The value is maintained by the system and changed depending on actions and transactions on the record. After accounting is completed, the system will change the document status to "accounting_completed." for a new document, the system will default the document status to "not_accounted."

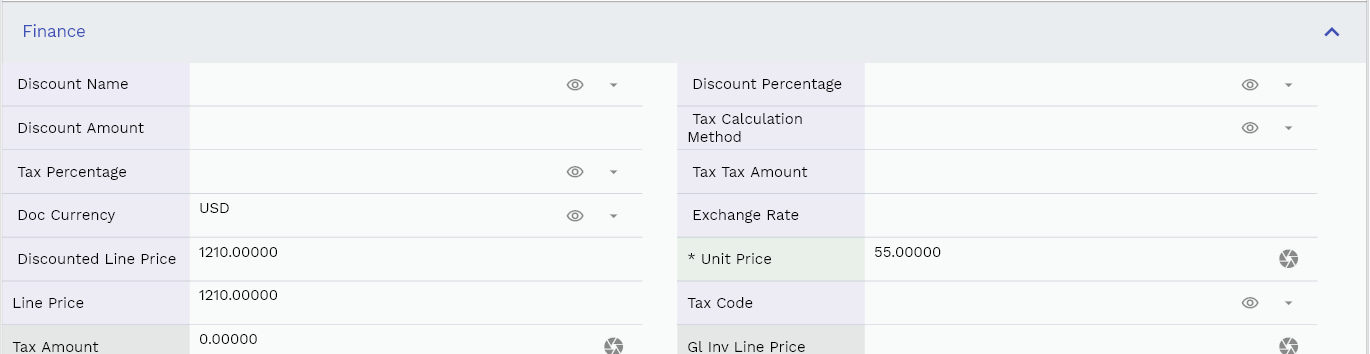

Scroll left, right, up, down to view all the details. The transaction line and details are shown in a separate tab. The default configuration shows fields in various functional groups such as

- Finance

- Entity

- Reference

- Data

- Control

- Etc

You can configure the application to show which fields should be shown under which group. You can also create new groups as per your business requirements.

All Fields

| Name | Sequence | Label | InputType | Field Group |

|---|---|---|---|---|

| 10 | vvBuOrg | Bu Org | deferredSelect | ENTITY |

| 10 | vvBuOrgCode | Bu Org Code | deferredSelect | ENTITY |

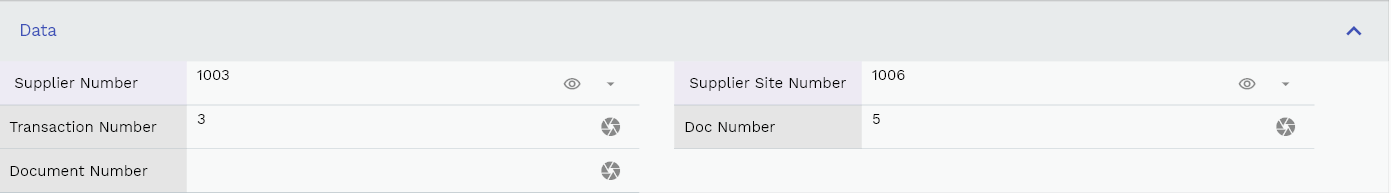

| 20 | vvSupplierNumber | Supplier Number | deferredSelect | DATA |

| 30 | vvSupplierName | Supplier Name | deferredSelect | ENTITY |

| 40 | vvSupplierSiteNumber | Supplier Site Number | deferredSelect | DATA |

| 50 | vvSupplierSiteName | Supplier Site Name | deferredSelect | ENTITY |

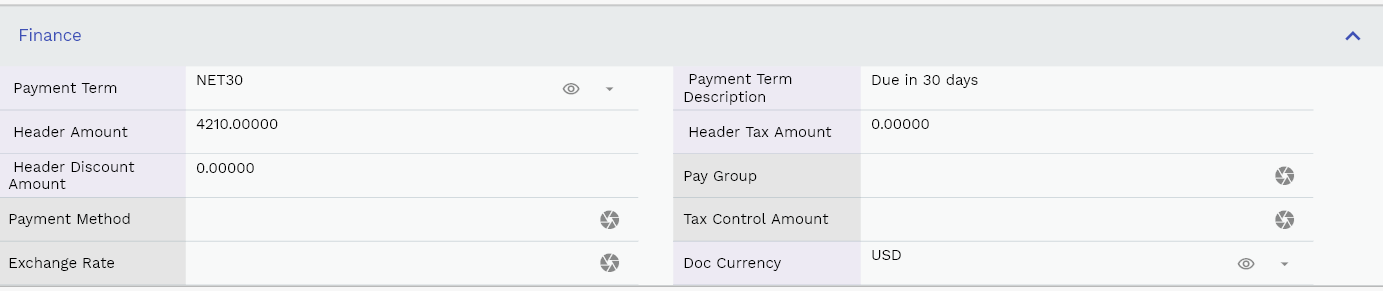

| 60 | vvPaymentTerm | Payment Term | deferredSelect | FINANCE |

| 70 | vvPaymentTermDescription | Payment Term Description | InputType.textField | FINANCE |

| 80 | vvHeaderAmount | Header Amount | InputType.textField | FINANCE |

| 90 | vvHeaderTaxAmount | Header Tax Amount | InputType.textField | FINANCE |

| 100 | vvHeaderDiscountAmount | Header Discount Amount | InputType.textField | FINANCE |

| 110 | apTransactionHeaderId | Ap Transaction Header Id | InputType.number | REFERENCE |

| 120 | srcEntityName | Src Entity Name | deferredSelect | DEFAULT |

| 130 | srcEntityId | Src Entity Id | InputType.textField | REFERENCE |

| 140 | buOrgId | Bu Org Id | deferredSelect | REFERENCE |

| 150 | transactionType | Transaction Type | InputType.select | CONTROL |

| 160 | transactionNumber | Transaction Number | InputType.textField | DATA |

| 170 | docNumber | Doc Number | InputType.textField | DATA |

| 180 | supplierId | Supplier Id | deferredSelect | REFERENCE |

| 190 | supplierSiteId | Supplier Site Id | deferredSelect | REFERENCE |

| 200 | hrEmployeeId | Hr Employee Id | InputType.textField | REFERENCE |

| 210 | description | Description | InputType.textField | DEFAULT |

| 220 | shipToId | Ship To Id | deferredSelect | REFERENCE |

| 230 | billToId | Bill To Id | deferredSelect | PLANNING |

| 240 | payGroup | Pay Group | InputType.textField | FINANCE |

| 250 | paymentTermId | Payment Term Id | deferredSelect | REFERENCE |

| 260 | paymentTermDate | Payment Term Date | InputType.date | DATE |

| 270 | paymentMethod | Payment Method | InputType.textField | FINANCE |

| 280 | taxControlAmount | Tax Control Amount | InputType.textField | FINANCE |

| 290 | exchangeRateType | Exchange Rate Type | deferredSelect | CONTROL |

| 300 | exchangeRate | Exchange Rate | InputType.textField | FINANCE |

| 310 | exchangeRateDate | Exchange Rate Date | InputType.date | DATE |

| 320 | dueDate | Due Date | InputType.date | DATE |

| 330 | docCurrency | Doc Currency | deferredSelect | FINANCE |

| 340 | transactionStatus | Transaction Status | InputType.date | CONTROL |

| 350 | documentNumber | Document Number | InputType.number | DATA |

| 360 | approvalStatus | Approval Status | InputType.select | CONTROL |

| 370 | referenceType | Reference Type | InputType.textField | CONTROL |

| 380 | referenceKeyName | Reference Key Name | InputType.textField | REFERENCE |

| 390 | referenceKeyValue | Reference Key Value | InputType.textField | REFERENCE |

| 400 | poHeaderId | Po Header Id | InputType.number | REFERENCE |

| 450 | docStatus | Doc Status | InputType.select | CONTROL |

| 460 | glAcProfileHeaderId | Gl Ac Profile Header Id | deferredSelect | REFERENCE |

| 470 | glPeriodId | Gl Period Id | InputType.number | REFERENCE |

| 480 | docRequestorType | Doc Requestor Type | InputType.select | CONTROL |

| 5410 | createdBy | Created By | InputType.textField | REFERENCE |

| 5420 | creationDate | Creation Date | InputType.dateTime | REFERENCE |

| 5430 | lastUpdatedBy | Last Updated By | InputType.textField | REFERENCE |

| 5440 | lastUpdateDate | Last Update Date | InputType.dateTime | REFERENCE |

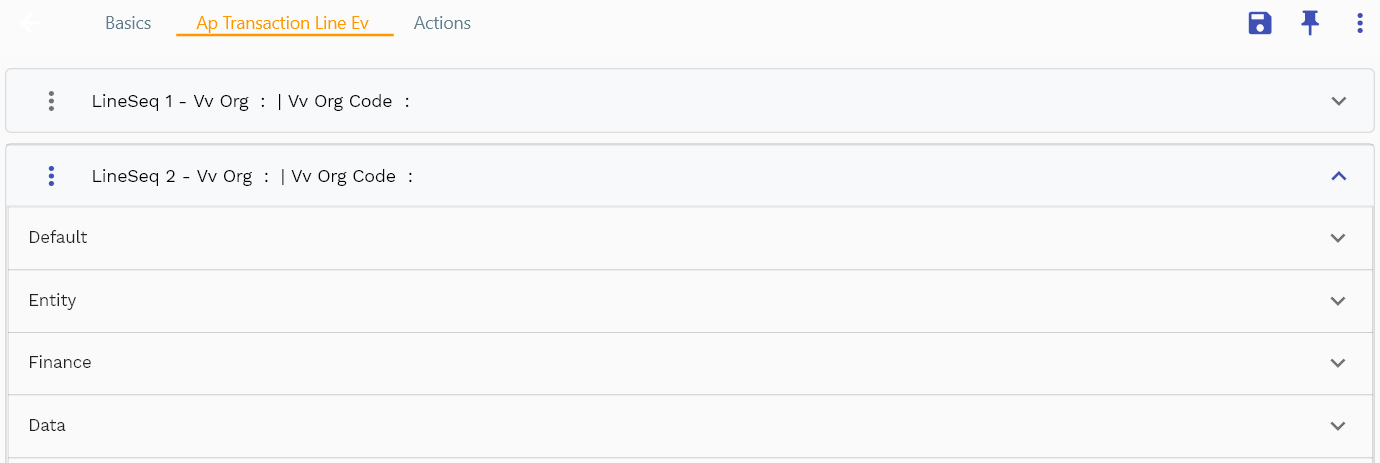

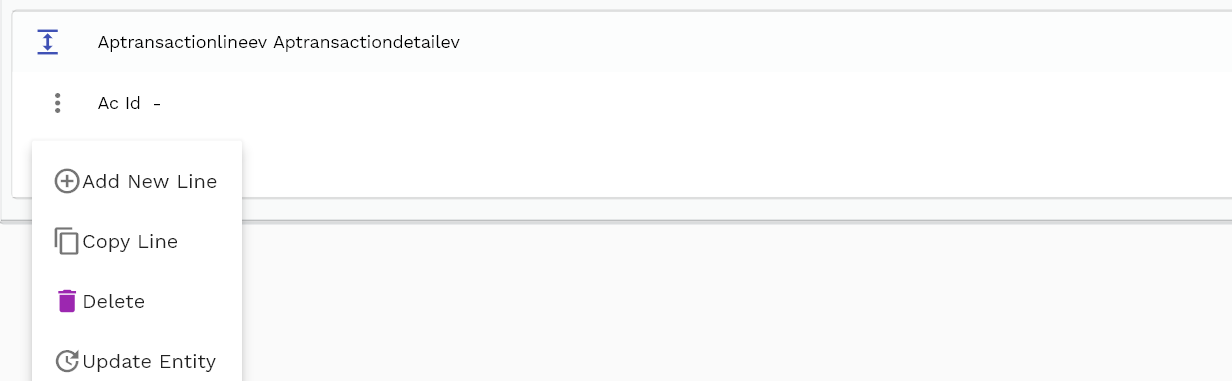

Lines

You can add multiple lines to each transaction header. Each transaction line contains an item, UOM, product description, quantity, received inventory organization, line number, unit price, etc.

Navigate to the lines tab to view/add/update lines.

Click on the add new entity to add a new line. If a line already exists, click on copy entity to copy all the details.

You can enable/disable fields allowed to be copied in the menu configuration.

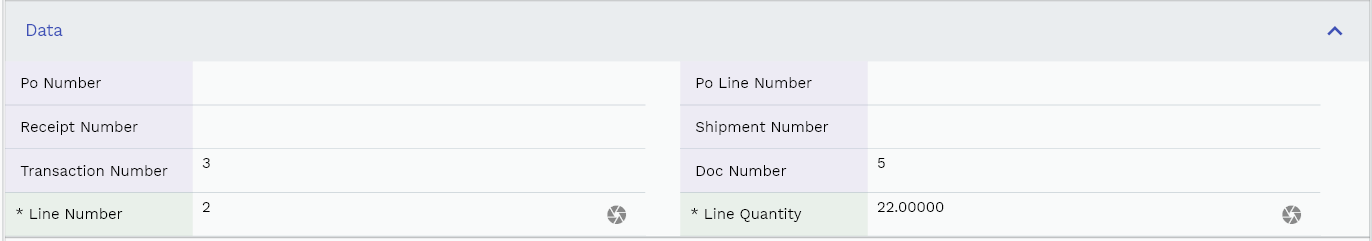

Line Number: Line number is a mandatory field. Enter a numeric value for the line

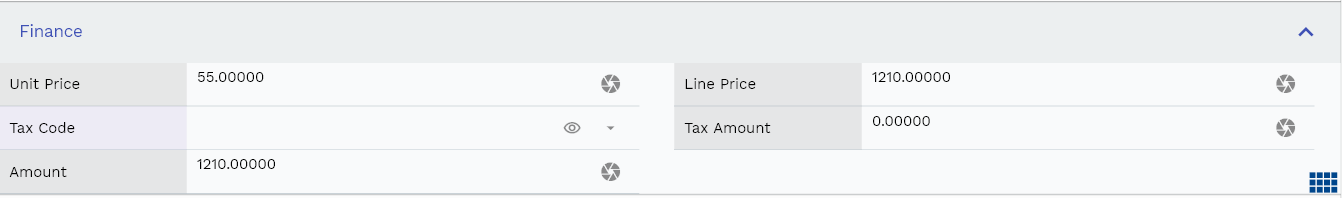

Line Quantity: Line quantity is a mandatory field. Enter a numeric value for the line quantity. The system uses the line quantity to create detail lines. System multiplies the line quantity with the unit price to calculate journal line amounts.

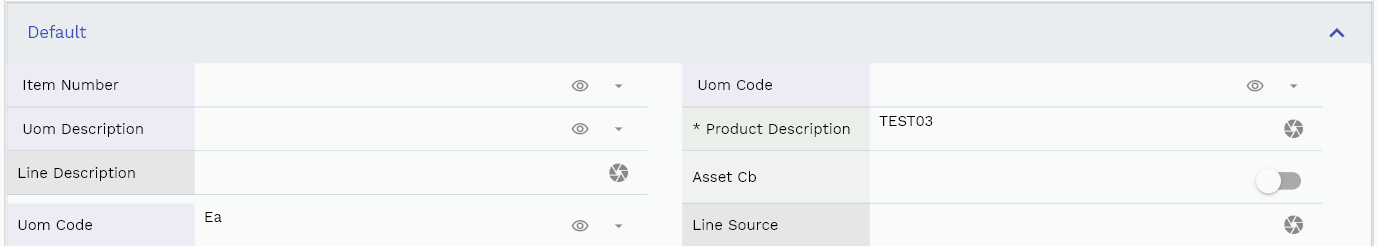

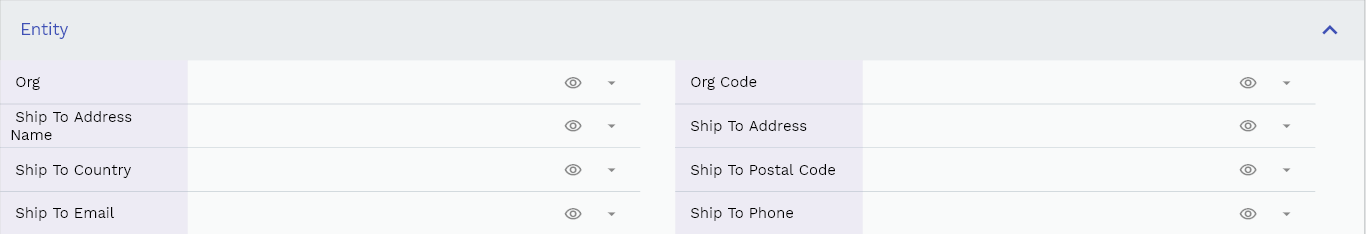

The entity group shows information related to business organization, supplier, etc.

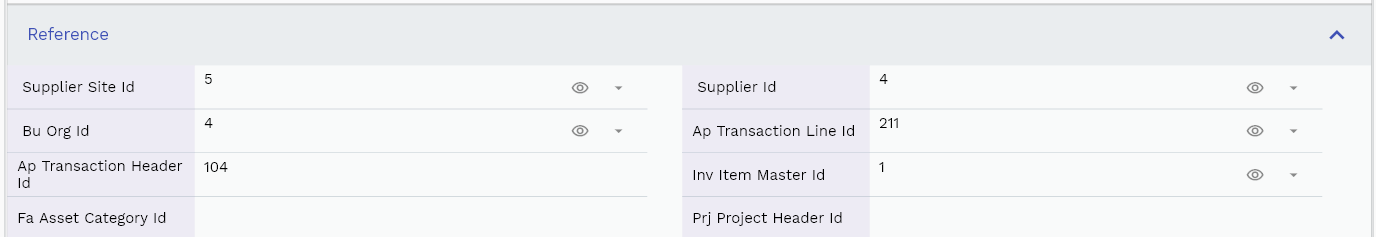

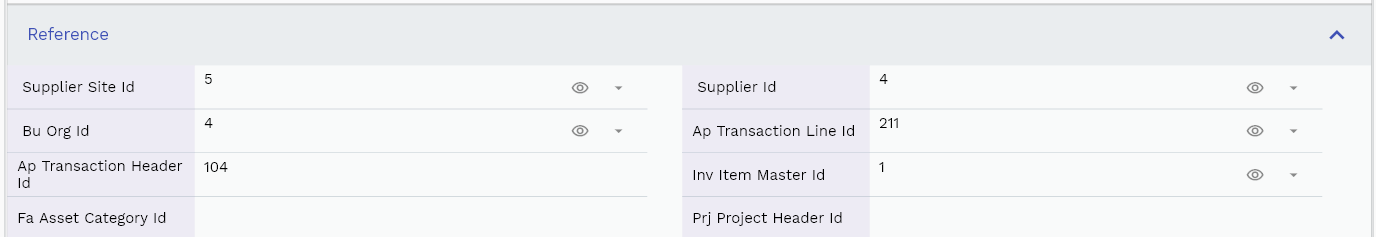

The reference groups show various ids for reference only. You don't need to enter any information in this section. When you save a transaction for the first time, the system will auto-populate the newly created header id and line ids.

In the finance section, enter the unit price. The system calculates the line price by multiplying the unit price with quantity. The header price is the sum of all the line prices. You don't need to enter any price at the transaction header.

Scroll left, right, up, and down view all other fields.

Enter all the other fields and click on the save button to save the transaction. The app will post all the data to the server and will show the messages returned from the server.

All Fields

| Name | Sequence | Label | InputType | Field Group |

|---|---|---|---|---|

| 10 | vvOrg | Org | deferredSelect | ENTITY |

| 10 | vvOrgCode | Org Code | deferredSelect | ENTITY |

| 20 | vvItemNumber | Item Number | deferredSelect | DEFAULT |

| 30 | vvUomCode | Uom Code | deferredSelect | DEFAULT |

| 40 | vvUomDescription | Uom Description | deferredSelect | DEFAULT |

| 50 | vvShipToAddressName | Ship To Address Name | deferredSelect | ENTITY |

| 60 | vvShipToAddress | Ship To Address | deferredSelect | ENTITY |

| 70 | vvShipToCountry | Ship To Country | deferredSelect | ENTITY |

| 80 | vvShipToPostalCode | Ship To Postal Code | deferredSelect | ENTITY |

| 90 | vvShipToEmail | Ship To Email | deferredSelect | ENTITY |

| 100 | vvShipToPhone | Ship To Phone | deferredSelect | ENTITY |

| 110 | vvDiscountName | Discount Name | deferredSelect | FINANCE |

| 120 | vvDiscountPercentage | Discount Percentage | deferredSelect | FINANCE |

| 130 | vvDiscountAmount | Discount Amount | InputType.textField | FINANCE |

| 140 | vvPoNumber | Po Number | InputType.textField | DATA |

| 150 | vvPoLineNumber | Po Line Number | InputType.number | DATA |

| 160 | vvTaxCalculationMethod | Tax Calculation Method | deferredSelect | FINANCE |

| 170 | vvTaxPercentage | Tax Percentage | deferredSelect | FINANCE |

| 180 | vvTaxTaxAmount | Tax Tax Amount | InputType.textField | FINANCE |

| 190 | vvReceiptNumber | Receipt Number | InputType.textField | DATA |

| 200 | vvShipmentNumber | Shipment Number | InputType.number | DATA |

| 210 | vvSupplierSiteId | Supplier Site Id | deferredSelect | REFERENCE |

| 220 | vvSupplierId | Supplier Id | deferredSelect | REFERENCE |

| 230 | vvTransactionNumber | Transaction Number | InputType.textField | DATA |

| 240 | vvTransactionType | Transaction Type | InputType.select | CONTROL |

| 250 | vvDocCurrency | Doc Currency | deferredSelect | FINANCE |

| 260 | vvDocNumber | Doc Number | InputType.textField | DATA |

| 270 | vvExchangeRate | Exchange Rate | InputType.textField | FINANCE |

| 280 | vvExchangeRateType | Exchange Rate Type | deferredSelect | CONTROL |

| 290 | vvBuOrgId | Bu Org Id | deferredSelect | REFERENCE |

| 300 | vvDiscountedLinePrice | Discounted Line Price | InputType.textField | FINANCE |

| 310 | apTransactionLineId | Ap Transaction Line Id | deferredSelect | REFERENCE |

| 320 | apTransactionHeaderId | Ap Transaction Header Id | InputType.number | REFERENCE |

| 330 | lineNumber | Line Number | InputType.number | DATA |

| 340 | invItemMasterId | Inv Item Master Id | deferredSelect | REFERENCE |

| 350 | productDescription | Product Description | InputType.textField | DEFAULT |

| 360 | lineQuantity | Line Quantity | InputType.textField | DATA |

| 370 | unitPrice | Unit Price | InputType.textField | FINANCE |

| 380 | linePrice | Line Price | InputType.textField | FINANCE |

| 390 | taxCode | Tax Code | deferredSelect | FINANCE |

| 400 | taxAmount | Tax Amount | InputType.textField | FINANCE |

| 410 | lineType | Line Type | InputType.select | CONTROL |

| 420 | lineDescription | Line Description | InputType.textField | DEFAULT |

| 430 | assetCb | Asset Cb | InputType.switchField | DEFAULT |

| 440 | faAssetCategoryId | Fa Asset Category Id | InputType.number | REFERENCE |

| 450 | prjProjectHeaderId | Prj Project Header Id | InputType.number | REFERENCE |

| 460 | prjProjectLineId | Prj Project Line Id | InputType.number | REFERENCE |

| 470 | uomCode | Uom Code | deferredSelect | DEFAULT |

| 480 | revenueAcId | Revenue Ac Id | InputType.number | REFERENCE |

| 490 | taxAcId | Tax Ac Id | InputType.number | REFERENCE |

| 500 | glTaxAmount | Gl Tax Amount | InputType.textField | PLANNING |

| 510 | glInvLinePrice | Gl Inv Line Price | InputType.textField | FINANCE |

| 520 | status | Status | InputType.textField | CONTROL |

| 530 | lineSource | Line Source | InputType.textField | DEFAULT |

| 540 | referenceType | Reference Type | InputType.textField | CONTROL |

| 550 | referenceKeyName | Reference Key Name | InputType.textField | REFERENCE |

| 560 | referenceKeyValue | Reference Key Value | InputType.textField | REFERENCE |

| 570 | poHeaderId | Po Header Id | InputType.number | REFERENCE |

| 580 | poLineId | Po Line Id | InputType.number | REFERENCE |

| 590 | poDetailId | Po Detail Id | deferredSelect | REFERENCE |

| 600 | refTransactionHeaderId | Ref Transaction Header Id | InputType.number | REFERENCE |

| 610 | refTransactionLineId | Ref Transaction Line Id | InputType.number | REFERENCE |

| 620 | periodId | Period Id | InputType.number | REFERENCE |

| 670 | lineDiscountAmount | Line Discount Amount | InputType.textField | FINANCE |

| 680 | discountCode | Discount Code | deferredSelect | FINANCE |

| 690 | approvalStatus | Approval Status | InputType.select | CONTROL |

| 700 | poReceiptLineId | Po Receipt Line Id | deferredSelect | REFERENCE |

| 5630 | createdBy | Created By | InputType.textField | REFERENCE |

| 5640 | creationDate | Creation Date | InputType.dateTime | REFERENCE |

| 5650 | lastUpdatedBy | Last Updated By | InputType.textField | REFERENCE |

| 5660 | lastUpdateDate | Last Update Date | InputType.dateTime | REFERENCE |

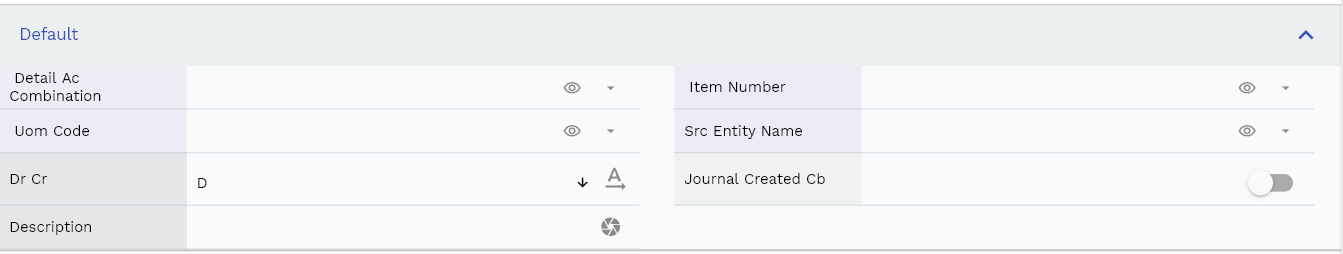

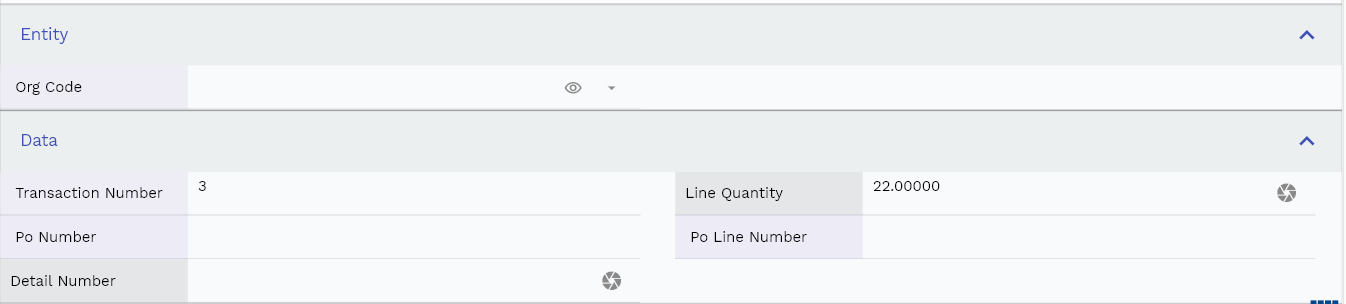

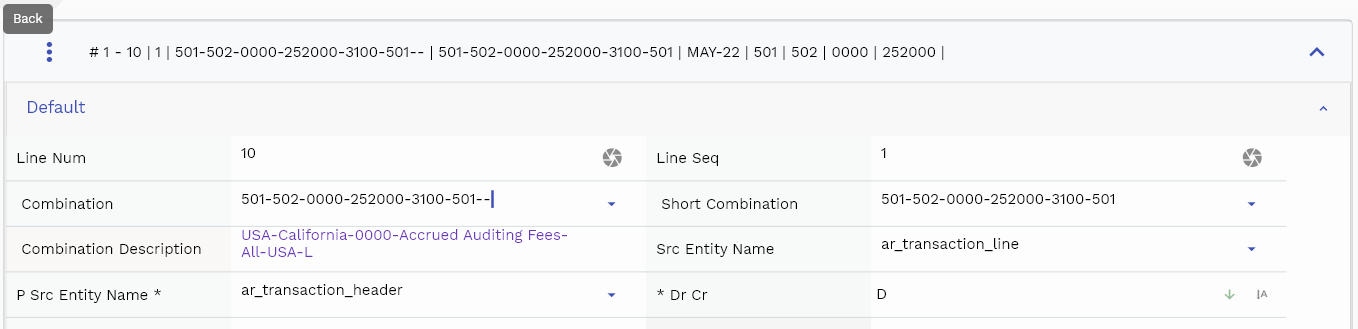

Details

The system creates multiple details for each line depending upon the line type (ITEM, FREIGHT, TAX, etc.). Though you don't need to regularly review/update transaction detail lines, It's advisable to review accounts and amounts after setup changes.

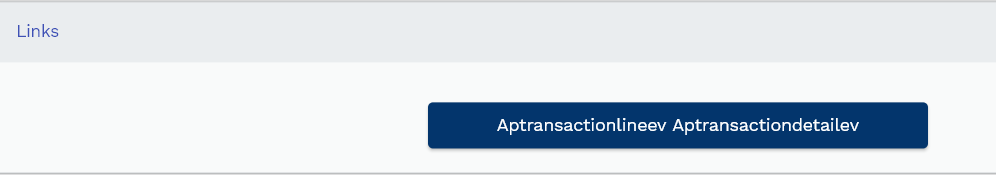

Depending upon your configuration, the details of a line are shown either on a separate tab or in the links section of lines.

Click on the Details button below a line to view/update/create details. By default, when saving any line system adds detail with the quantity, price, and account details. You can add multiple details and change the account/quantity as per your actual requirement.

Click on the expandable button to view the fields of a detail line.

To create a new detail, click on Add New Line button. You can also copy an existing detail line to a new one by clicking on the Copy Line button.

In the data section, enter the detail line number. The system always creates the first line as line number 1, but you can change it. While adding a new detail line, enter a detail line number as its mandatory field. Enter the detail quantity in the quantity field.

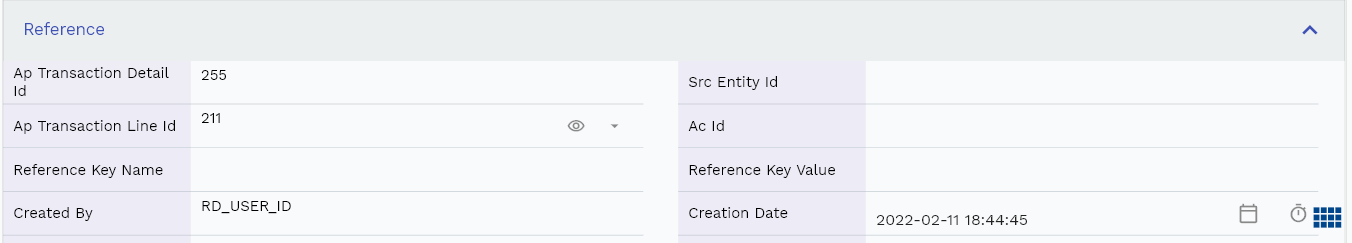

The reference groups show various ids for reference only. You don't need to enter any information in this section.

All Fields

| Name | Sequence | Label | InputType | Field Group |

|---|---|---|---|---|

| 10 | vvDetailAcCombination | Detail Ac Combination | deferredSelect | DEFAULT |

| 10 | vvOrgCode | Org Code | deferredSelect | ENTITY |

| 20 | vvItemNumber | Item Number | deferredSelect | DEFAULT |

| 30 | vvTransactionNumber | Transaction Number | InputType.textField | DATA |

| 40 | vvUomCode | Uom Code | deferredSelect | DEFAULT |

| 50 | lineQuantity | Line Quantity | InputType.textField | DATA |

| 60 | unitPrice | Unit Price | InputType.textField | FINANCE |

| 70 | linePrice | Line Price | InputType.textField | FINANCE |

| 80 | taxCode | Tax Code | deferredSelect | FINANCE |

| 90 | taxAmount | Tax Amount | InputType.textField | FINANCE |

| 100 | vvPoNumber | Po Number | InputType.textField | DATA |

| 110 | vvPoLineNumber | Po Line Number | InputType.number | DATA |

| 120 | apTransactionDetailId | Ap Transaction Detail Id | InputType.number | REFERENCE |

| 130 | srcEntityName | Src Entity Name | deferredSelect | DEFAULT |

| 140 | srcEntityId | Src Entity Id | InputType.textField | REFERENCE |

| 150 | apTransactionLineId | Ap Transaction Line Id | deferredSelect | REFERENCE |

| 160 | detailNumber | Detail Number | InputType.number | DATA |

| 170 | acId | Ac Id | InputType.number | REFERENCE |

| 180 | accountType | Account Type | InputType.select | CONTROL |

| 190 | drCr | Dr Cr | InputType.select | DEFAULT |

| 200 | amount | Amount | InputType.textField | FINANCE |

| 210 | journalCreatedCb | Journal Created Cb | InputType.switchField | DEFAULT |

| 220 | status | Status | InputType.textField | CONTROL |

| 230 | referenceType | Reference Type | InputType.textField | CONTROL |

| 240 | referenceKeyName | Reference Key Name | InputType.textField | REFERENCE |

| 250 | referenceKeyValue | Reference Key Value | InputType.textField | REFERENCE |

| 260 | description | Description | InputType.textField | DEFAULT |

| 5270 | createdBy | Created By | InputType.textField | REFERENCE |

| 5280 | creationDate | Creation Date | InputType.dateTime | REFERENCE |

| 5290 | lastUpdatedBy | Last Updated By | InputType.textField | REFERENCE |

| 5300 | lastUpdateDate | Last Update Date | InputType.dateTime | REFERENCE |

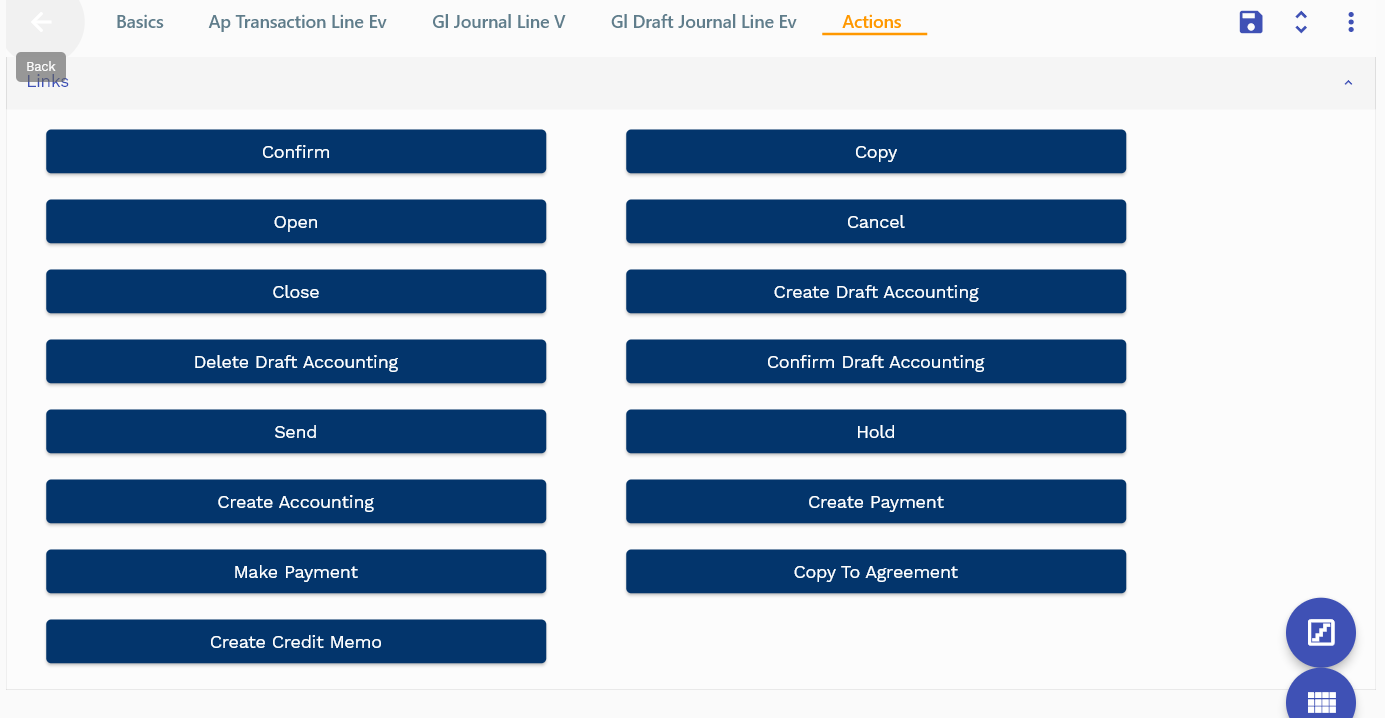

Actions

Actions allow you to change the status of the transaction. The system creates transactions in draft status. When you are ready to publish the transaction and send it to the supplier, change it to Confirmed. You can cancel a transaction by clicking on the Cancel button. Similarly, you can close any transaction by clicking on the Close button.

A confirmed transaction can be converted to other documents, and the corresponding buttons are available in the actions section.

Accounting

The accounting process in inoERP is quite flexible, and you can configure the system to generate the accounting details for any business process.(Refer to Journals for more details)

If you enter any accounting profile on the transaction header, the system will use the accounting profile to derive the accounts. Else, the system will use the default accounting profile for the business unit.

You can default accounting profile from 3 levels

- Transaction

- Billing Document Type

- Business Unit

Invoice

DR Charge/Expense/Accrual

DR Tax

DR Freight

CR Liability

Credit Memo

CR Liability

DR Charge/Expense/Accrual

DR Tax

DR Freight

Line Categories

In AP, the system will allow you to use separate accounts for below line categories:

- item

- freight

- expense

- charge

- misc

- tax

- misc

- misc1

So, if an invoice has any line with any of the above line categories, the system will use the corresponding accounts.

Example:

Line 1: Inventory Item

Line 2: Charge

Line 3: Misc

Accounting Entries For Line 1

DR Accrual Account: Inventory Item

CR Liability Account : Supplier

Accounting Entries For Line 2

DR Charge Account

CR Liability Account : Supplier

***Accounting Entries For Line ***

DR Misc Account

CR Liability Account : Supplier

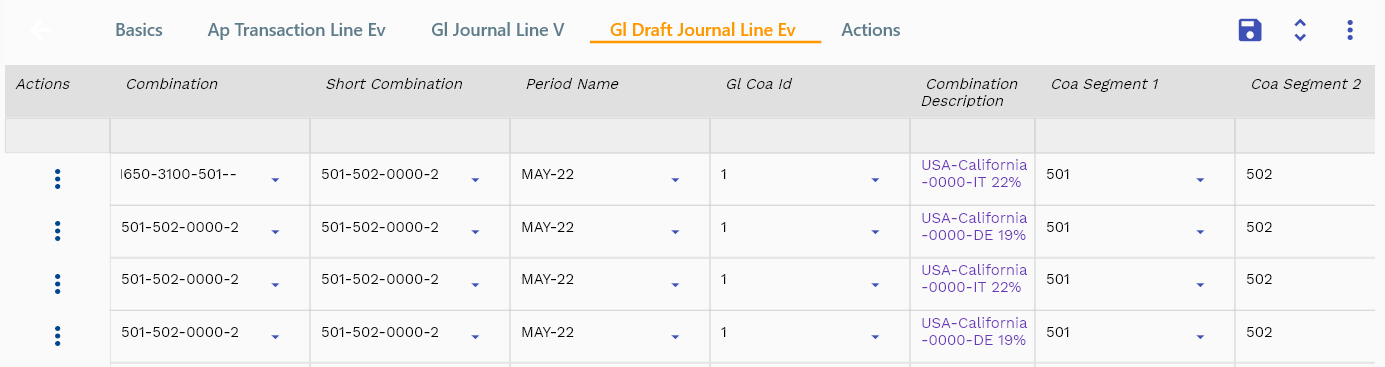

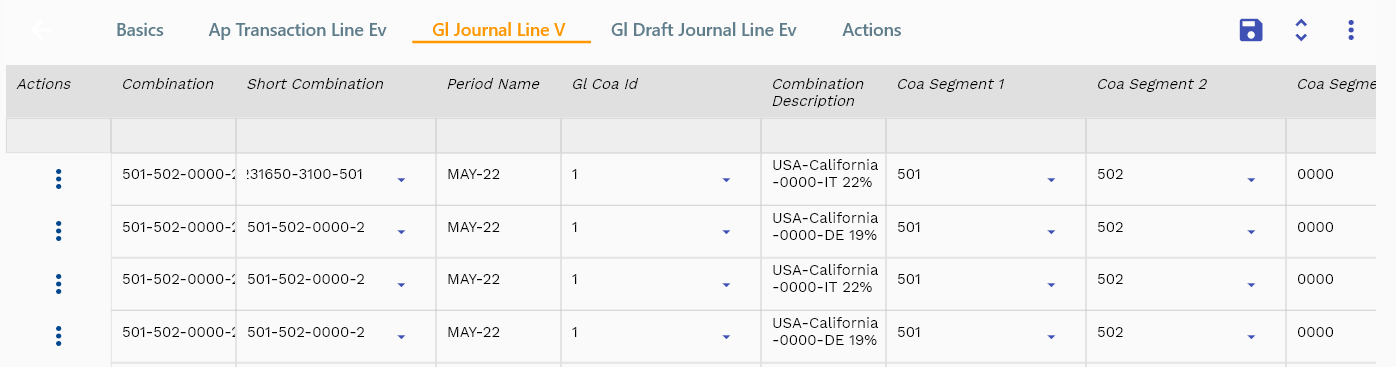

Draft Accounting

You can view the details of the draft accounting entries in the draft accounting tab. Draft accounts are generated when you click on the "Create Draft Accounting" button. The draft accounting entries always delete the existing entries. You can also manually delete the draft accounting entries by clicking on the "Delete Draft Accounting" button.

The system allows you to update the draft accounting entries. You can edit the debit and credit amounts and also the accounts. To create journal entries with your updated values, use the "confirm draft accounting" button.

You can use the "create accounting entries" button to create journal entries with the original values.

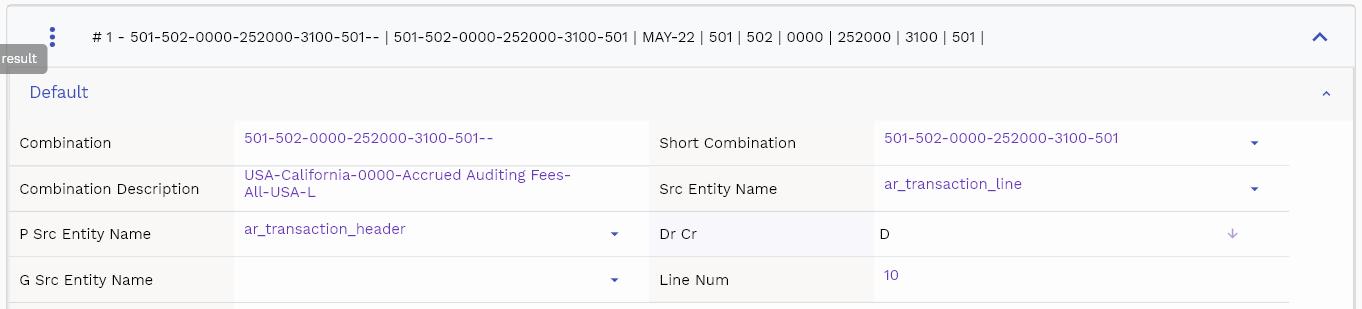

Combination

The GL account code combination is a mandatory field. You can rename the field as per the term of your existing accounting system.

The system derives the GL account code from the selected accounting profile. If you change the accounting combination, the system will default all the other related fields from the chosen combination.

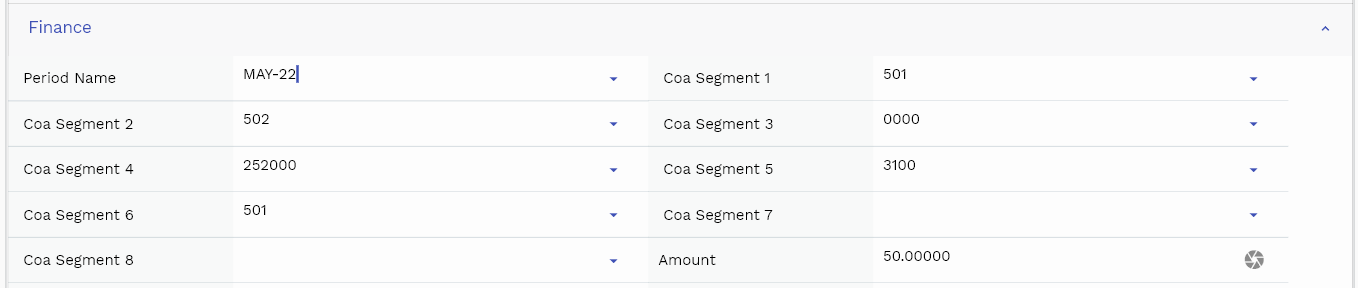

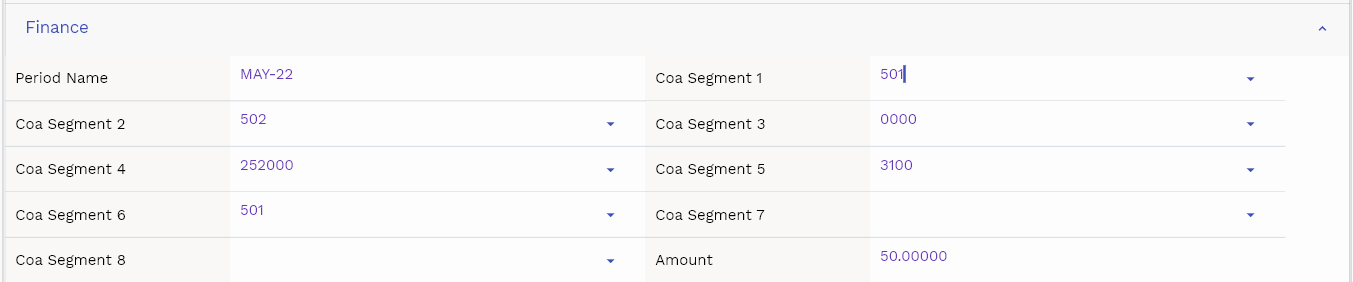

Period Name

A read-only field. It displays the period name for the selected period—the value defaults from the Draft Journal Header.

Amount

The amount is a mandatory field. You can enter the amount in the currency of the selected business unit.

D or C

The D or C field is a mandatory field. You can select either Debit or Credit.

Final Accounting

You can view the details of the final accounting entries in the final accounting tab. Final accounts are generated when you click on the "Create Accounting" button. The final accounting entries can't be deleted and can only be updated on the Journal screen (Updates are only allowed before posting).

Combination

The GL account code combination is a mandatory field. You can rename the field as per the term of your existing accounting system.

The system derives the GL account code from the selected accounting profile. If you change the accounting combination, the system will default all the other related fields from the chosen combination.

Period Name

A read-only field. It displays the period name for the selected period—the value defaults from the Journal Header.

Amount

The amount is a mandatory field. You can enter the amount in the currency of the selected business unit.

D or C

The D or C field is a mandatory field. You can select either Debit or Credit.

Credit Memo

The process of creating a credit memo is the same as creating an invoice. Follow the steps mentioned in Header, Line & Detail section to create a credit memo. Select the document type as "Credit Memo."

You can also convert an invoice to a credit memo using the "Convert to credit" action.